This guide covers setting up a “private company limited by shares” which is the most popular type of company registered in the UK. This type of company is typically used to register a business which will trade for profit or hold assets.

Contents

-

Choosing a company name

THE most Important part of starting a company.

This can go wrong with expensive legal consequences if somebody objects to the name you choose. -

"Trading as" business names

Limited companies can use ‘trading as’ business names alongside the company name that they register with the government. If you want to use a trading as name you don’t need to register it but you do need to follow a few basic rules.

-

Checking a company name is available

There are 4 main checks that you should do to find out if a company name is available. You have to be really careful with this as the government will only do one of the checks for you. We explain the steps you need to take to check if your company name is available.

-

The company registration process

We talk you through the steps involved and cover the fees that have to be paid to the Government.

-

The requirements for setting up a limited company

We detail all of the information that is required to start a limited company in the UK (including a link to download our handy checklist).

-

The registered office address

Every limited company has to have a registered office address. The address you pick will decide the jurisdiction your company is in. Registered office addresses are public information. We detail the steps you can take to protect your privacy.

-

Appointing company directors

Your company directors will be responsible for making sure your limited company is run correctly. We explain who can be a limited company director and how they are appointed.

-

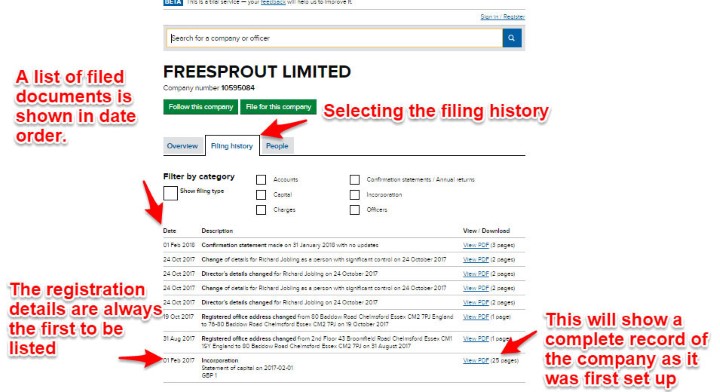

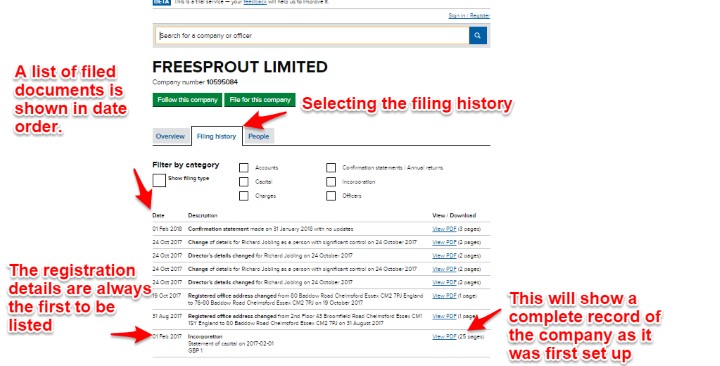

Directors addresses

Limited company directors have to provide their residential address to the government and this will be put on the government website unless you follow the appropriate steps to hide it. We explain what you need to know about director addresses.

-

Company shareholders

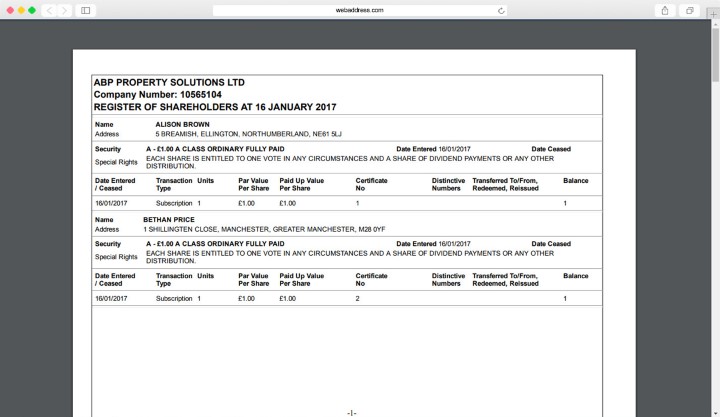

The shareholders of a limited company are the ones who own it. They get a share of any profits and can vote on important decisions. Like company directors their details are public information but there are steps you can take to protect shareholder privacy.

-

Allocating shares

For most limited companies allocating shares is very simple but most people get it wrong on their first try. We explain what you need to do for a simple limited company setup and look at some of the more share allocations that can be done.

-

PSC's - people with significant control

New limited companies have to state who their Person with Significant Control (PSC) is. This is to try and stop people hiding behind nominee directors and to clamp down on money laundering, fraud and other misuse of limited companies.

-

SIC codes

All limited companies have to tell the government what industry they are in via a Standard Industrial Classification (SIC) code. This code is used for statistical purposes and does not dictate what the company can and can’t do.

-

Registration paperwork

There are two main bits of paperwork you will be issued with by the government when your limited company is registered. We explain what this paperwork is, what it looks like and what it is used for.

-

Minutes of the first board meeting

All limited companies have to hold an initial board meeting even if there is only one company director. We explain why this board meeting is necessary and the documentation you need to have to prove it happened.

-

Share certificates

Shareholders own a limited company and the share certificates show how much of the company each one owns. The government don’t provide share certificates for limited companies but you are legally required to have them.

-

Company registers

Otherwise known as the statutory registers this is a series of documents all limited companies are legally required to have. We explain what the registers are and the different options available to you for storing them.

1 - Choosing a company name

How to choose a company name.

This is the part of setting up a limited company that can go really wrong.

Why?

Because it's easy to pick a name that another business is using or is too similar to a name they are using.

Existing businesses can claim rights to stop you registering your chosen name as a limited company even if their registered company name is not the same as yours. For instance if they have trade mark protection for the name.

So let's kick off with a few basic things to keep in mind and then dig into the rules a bit deeper.

"Make sure your name is unique."

The golden rule when setting up a limited company is a unique company name.

No two companies can be registered with the same name, or a name which is too similar to an existing company.

If a name is already taken, it is perfectly acceptable to add words to the company name to make it unique.

However, just because a name is unique and Companies House will let you register it, doesn't mean somebody won't object to it later.

Look at these examples of fish and chip shops using variations of the same name:

Just be careful the name doesn't get too long if you are going to use your company name as your "trading name".

"Avoid long and confusing names"

Imagine using your name in real world scenario.

The same applies for domain names and email addresses, these can get out of hand too.

Remember when it comes to business names, length really does matter.

shorter is better.

- How will it sound when you answer the telephone?

- Could the name be easy to mis-spell? or

- Will you permanently be spelling the name for potential clients.

"Make sure it's easy to pronounce"

Making up a name or using foreign words is an easy way to ensure your name is unique (and can also help you be bang on trend).

The Danish word "Hygge" is one current example of a word that became fashionable in UK company names.

Roughly translated it means a quality of cosiness (= feeling warm, comfortable, and safe).

Pretty cool if you have a lifestyle type business. But how do you pronounce it?

This is how to pronounce "Hygge".

As your company name will be a key part of how you market your business and build your brand it is worth thinking about carefully.

A made up name could be a good icebreaker, explaining how to pronounce it;

Or it could a waste of time distracting from talking about your product or service?

It might also make word of mouth marketing difficult down the line?

2 - "Trading as" or "business names"

What are 'trading as' business names?

"Business names", otherwise known as ‘trading as’ names, or "trading styles" are a common way to brand your business.

"Trading as" names are not the same thing as your registered company name.

They are names that your limited company can choose to use to trade under, but do not have to be the same as your company name.

You don't have to have a seperate trading name but it's another option open to you when you are setting up your limited company.

The key point is trading names are what really matter, you can call your limited company something entirely different to ensure it is unique.

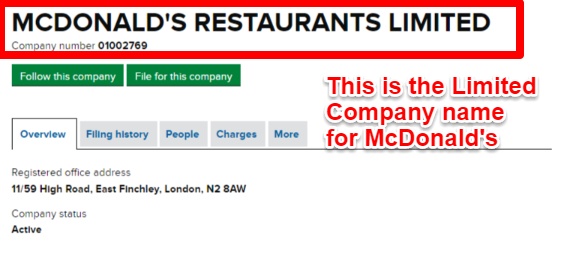

"McDonald's" is an example of a "trading as" name.

The actual limited company name registered at Companies House is "McDonald's Restaurants Limited" - but that wouldn't look too snappy on a sign outside their restaurant woud it?

Here's their company record from Companies House.

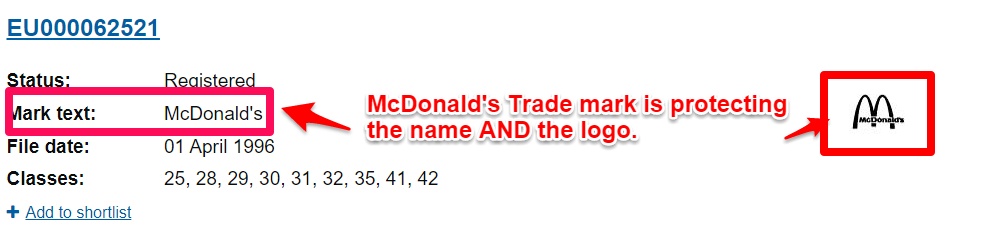

And just for the sake of completeness, here is the registered trade mark entry for McDonald's. Trade Marks are registered separately and held on a database by the Intellectual Property Office (known as the IPO).

How do trading as names work?

Trading as names are often used where a company does more than one thing.

So, for instance, you might have a general building company called ABC Builders Ltd but you want to branch out and start doing loft conversions.

Instead of marketing your loft conversion services as ABC Builders Ltd you could do it as ABC Builders Ltd t/a Amazing Loft Conversions.

Or if you have registered the domain name AmazingLoftConversions.Co.UK

PLUG: (we do domain names too)

you might use ABC Builders Ltd t/a AmazingLoftConversions.Co.UK

On the website, brochures, adverts and other marketing materials for your loft conversion business, Amazing Loft Conversions or AmazingLoftConversions.Co.UK, would be the trading name of your limited company.

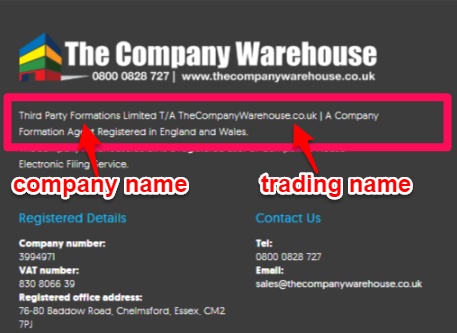

You just have to have the ABC Builders Ltd t/a Amazing Loft Conversions in the small print. (If you look at our website you will see Third Party Formations Limited t/a TheCompanyWarehouse.Co.UK at the bottom of each page).

Limited companies can have as many trading styles as they like, as long as it is always clear who the limited company is that is using it.

You must also tell your bank that you intend to use a trading style as they will not accept cheques and other payments made out to the trading name rather than the name of your limited company.

How to register a "trading as" name:

Business names and trading names are not required to be registered anywhere. They are simply a tool of the trade.

You just need to register a limited company and "adopt" a trading style when you are ready to trade.

Protecting your "trading as" name.

While you do not have to register your trading name anywhere, you will want to make sure it is protected from anyone else using it.

This is particularly the case if you have two or more trading styles for one limited company business. For instance you might have two websites with very different names.

In the example above ABC Builders Limited might have websites on these domains ABCbuilders.Co.Uk and Amazingloftconversions.co.uk.

So what would happen if somebody else decided to register Amazing Loft Conversions Limited?

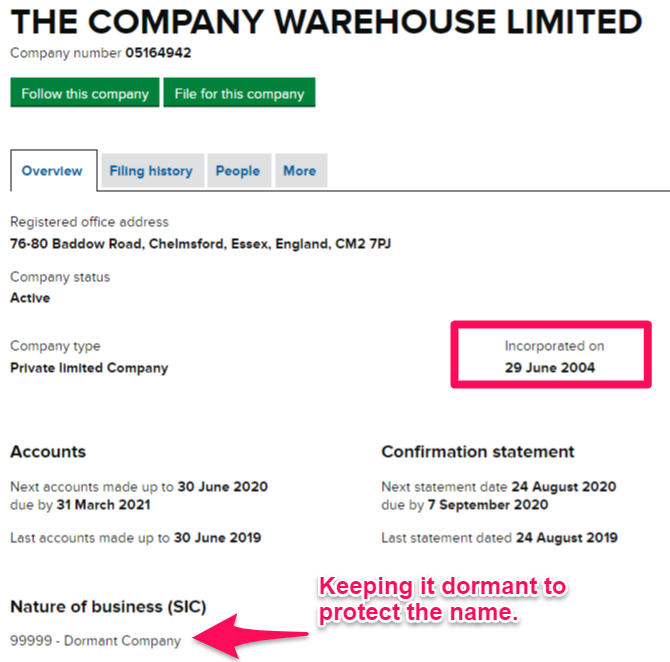

One way to stop this happening is by registering the trading as name as another company, but keeping that company dormant.

That's what I do with "The Company Warehouse".

This stops anyone else registering a company with that name or even with one that is similar. It can also help to establish your rights to that name if there is ever a dispute about it.

The best protection for a "trading as" name, or any business name for that matter, is to apply to register a trade mark. A trade mark gives the strongest legal protection against anybody else copying your name that trades in the same industry.

Trade Marks cost a bit more to register initially and take longer to get registered, however they do last for 10 years.

Checking trading as names

Before deciding on a trading as name you should run the same checks on the name that you would for a company registration, This is to make sure no-one else is already using that name, or has established rights in the name as their intellectual property.

3 - Checking a company name is available

Company name search tools

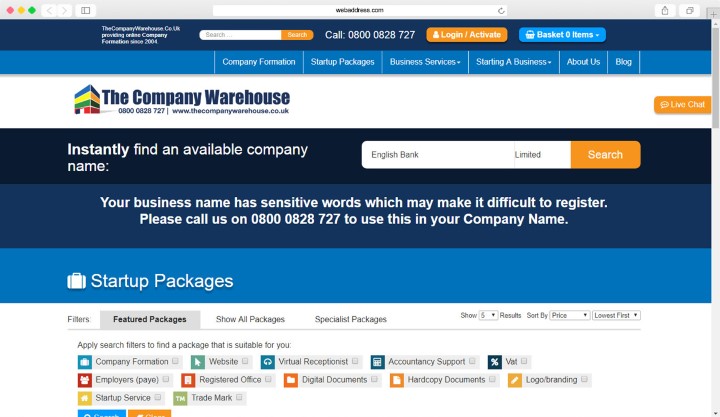

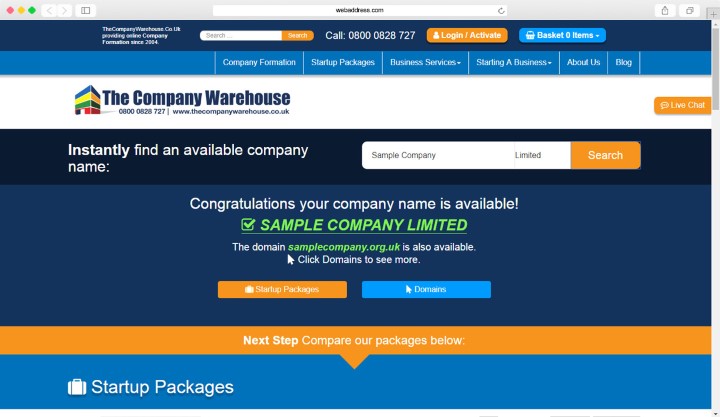

You will only be allowed to register your company name if it is unique. You cannot register the same name as an existing company or one that is too similar. Our online search tool will tell you if your company name is available.

It will also flag up potential problems with sensitive words. These are words like ‘bank’ or ‘insurance’ which can only be used by properly regulated companies.

There is a full list of sensitive words in our company name guide but our online company name search tool will tell you if your chosen name contains any.

If your company name is available and there are no sensitive words in it then you should be good to go. However, there are a couple of final checks you should make. If your new business is going to have any kind of presence online, like a website or email, then you will want to check that the domain names are available. Our online company name search will do this for you.

Checking for company name conflicts

As long as a company name is unique Companies House will allow you to register it. It isn't their job to check it.

Company names which breach other people’s trade marks and intellectual property.

In the past we have had people registering companies like ‘Twitter UK Ltd’, ‘Microsoft Technical Support Ltd’ and ‘Virgin Spacecraft Ltd’.

We told them.

None of these people was anything to do with the real Twitter, Microsoft or Virgin and they very quickly got letters from some very expensive lawyers telling them to stop immediately or get sued.

These are extreme examples but it is easy to accidently use a name someone else has ownership of. There are a few steps you can take to reduce the chances of getting yourself in trouble.

- Do a Google search for the company name you want – I know that sounds a little silly and basic but you would be surprised at the number of people who don’t do this when registering a new company. 76% of businesses in the UK are sole traders. They do not have to register their business name anywhere and they won’t show up on the Companies House name search. However, if they have any kind of established brand name then they are likely to show up in Google. Doing a Google search for your company name will also let you see what other websites might show up when your customers are trying to find your business.

- Check social media – Virtually all businesses will want to have a presence on Facebook, Twitter and the other main social networks. You will therefore want to make sure that the Twitter handle and Facebook usernames that match your new company name are available. As well as helping your future marketing efforts this will also help you identify any companies or organisations who might already be using your company name.

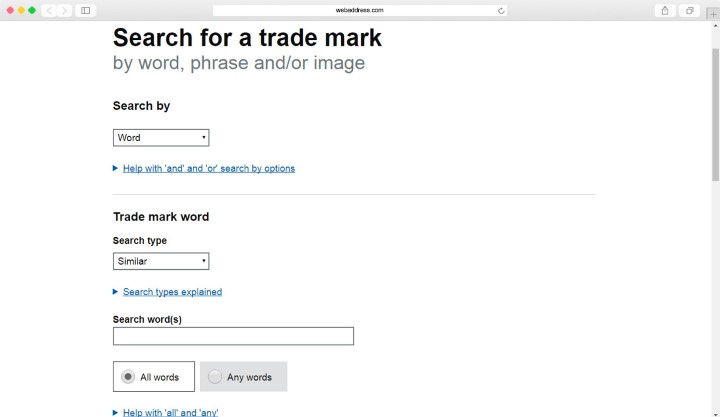

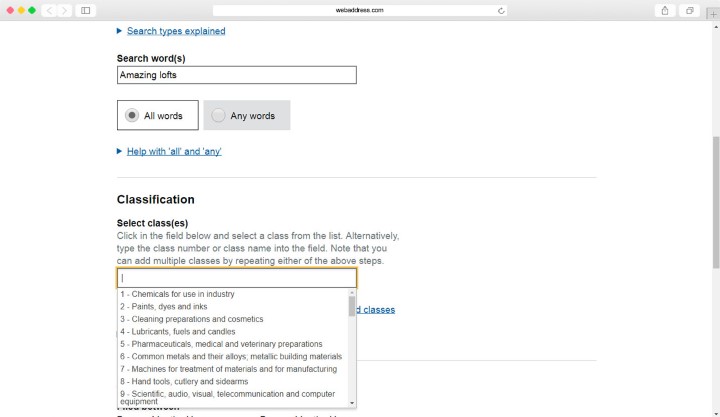

- Search for Trade marks at the IPO – Trade marks are the strongest form of protection available for company and brand names in the UK. Trade marks can be registered in 45 different classes which relate to different industries. Two companies can register the same name as trade marks as long as they are in different classes. So, when you do a trade mark search you need to ensure that you are checking all classes that are relevant to your business.

The IPO trade mark search gives you a lot of options, you can search by words or images and can search different date ranges and by different types of matches.

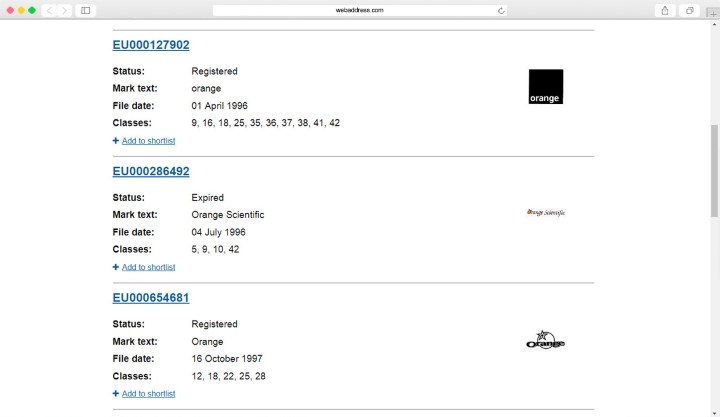

Fig 4.

If a trade mark is found that matched your criteria you will be shown a list of the trade marks and what classes they are registered in. In this case we have searched for the word ‘orange’ and we can see that there are multiple trade marks registered across a range of different trade mark classes.

4 - The company registration process

Getting your company registered

Once you have a name that you are happy with, and you have chosen a company formation package, we can get started with setting up your limited company.

All limited companies in the UK get registered with Companies House who are the government body responsible for maintaining the official company register. You can register your company direct with Companies House or you can use TheCompanyWarehouse.co.uk who can do the work for you and provide extra services that Companies House don’t offer.

Irrespective of whether you register at Companies House, TheCompanyWarehouse.co.uk or another formation agent all limited companies are registered in the same way. Once you have entered your company details we will send these electronically to Companies House. Once received at Companies House the application is placed in a queue until it is passed to a human inspector who assesses it. If the inspector is satisfied that the application meets all of the requirements the company will be issued with the next available company number. A certificate of incorporation will be generated and the company’s details will be placed on the public record. The Companies House database is available on the internet and your company information will feature in popular search engines such as Google.

How long does it take to set up a limited company?

There are a lot of claims online regarding how long it takes to setup a limited company. As all limited company applications have to pass through human inspectors in an office environment there can be variation in how long it takes for a company application to be processed. We normally say to allow 5 hours between the company being submitted and a company number being issued. Companies House standard working hours are 9 am to 5 pm Monday to Friday. They do sometimes work outside of these hours to accommodate heavy workloads. Companies do occasionally get registered on a Saturday but this is rare.

TheCompanyWarehouse.co.uk and Companies House both provide a guaranteed same day incorporation service. While our same day service can be done over the phone the Companies House guaranteed same day incorporation can only be done by paper application (it is not available online) and their filing fee is £100.

Same day incorporations must be delivered (either in paperwork or electronically) by 3pm. TheCompanyWarehouse.co.uk has filed electronic same day applications as late as 4pm and still had the company registered the same day.

In our experience it is unusual for clients to pay the same day filing premium but we have filed these types of applications for clients who:

- Wanted to make sure their company wasn’t registered on Friday the 13th.

- Wanted a company registered on a specific day as their Feng Shui consultant had advised them it was the best day to register a company.

Clients who wish to ensure they win a ‘name race’. In our experience a ‘name race’ typically occurs when two or more individuals have the same idea for a company name (usually in the pub).

How much does it cost to set up a limited company?

If you go direct to Companies House it will cost you £12 to set up a limited company but this will not include most of the paperwork you are legally required to have. The Company Warehouse offer a range of company formation packages, including ones which do give you the legal paperwork that you need. Take a look at our company formation packages to see our latest prices.

| Service | TheCompanyWarehouse.Co.uk | Companies House |

|---|---|---|

| Online Company Formation (Ltd By Shares) |

£50 | £50 |

| Online Same day | £78 | 78 |

| Paper forms | Not available | £71 |

| Paper forms same day | Not available | £Withdrawn |

TheCompanyWarehouse.co.uk will always pay the £50 filing fee for you, even if the package price is lower than £50

5 - The requirements for setting up a limited company

What do you need?

The minimum requirements you will need to start a new company are:

-

A company name

-

An official address to register the company to (called the registered office address)

-

At least 1 director

-

At least 1 shareholder

-

You will need to pick at least 1 SIC code that describes the trading activities of your company.

-

Details of the person or people involved such as their eye colour, mothers maiden name and town of birth. See table below:

-

You might get asked for some ID and proof of your address but this isn’t always needed.

You will also need to submit Memorandum and Articles of Association when setting up a limited company.

This is the rulebook for your company and sets out the rules on things like who can vote on company decisions. If are setting up a limited company via a company formation agent like The Company Warehouse, or if you go direct to Companies House, model articles with a standard set of rules will be supplied for you.

|

Salutation (mr/mrs/miss etc) |

|

Full name |

|

Full residential address and postcode |

|

Directors service address and postcode (optional) |

|

Phone number |

|

Date of Birth |

|

Nationality |

|

Occupation |

|

Town of birth |

|

Mother’s maiden name |

|

Eye colour |

|

Number of shares (if any) |

6 - Registered office address

What is a registered office address?

The registered office address is the ‘legal service address’ for your company. It is where Companies House and HMRC will send any letters for the company. If your company is subject to any legal proceedings this is the address where the court paperwork will be sent.

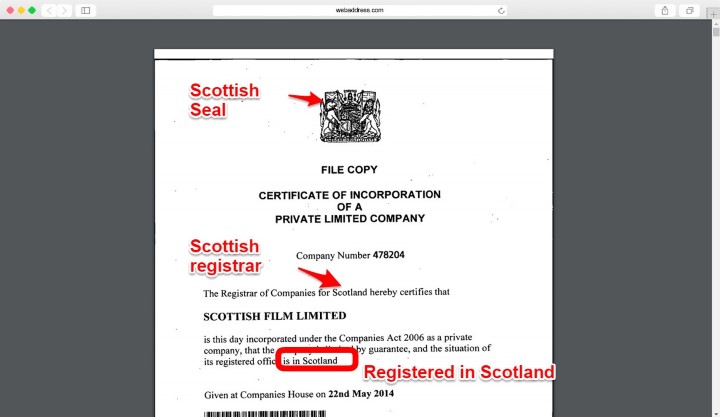

Understanding jurisdiction

The registered office address that you use when you first register a company determines the jurisdiction (type) of company that will be registered:

-

If the first registered office is an address in Scotland the company will be registered as a Scottish Limited Company (Scottish company numbers are pre-fixed SC);

-

If the first registered office is an address in England the company will be registered as an English and Welsh Limited Company.

-

If the first registered office is an address in Wales the company will be registered as an English and Welsh Limited Company, or optionally a “Welsh Company”.

The jurisdiction is shown on the Certificate of incorporation”

Can I change my registered office address?

A company can change its registered office address but cannot change jurisdiction. So, for instance a Scottish company must always maintain a registered office address in Scotland.

Can I use my home address as a registered office address?

One of the most common questions we are asked is whether it is permitted to use a home address as a registered office address. This is perfectly acceptable, the word ‘office’ in ‘registered office address’ is a legal term and in practice any address is capable of being a registered office address.

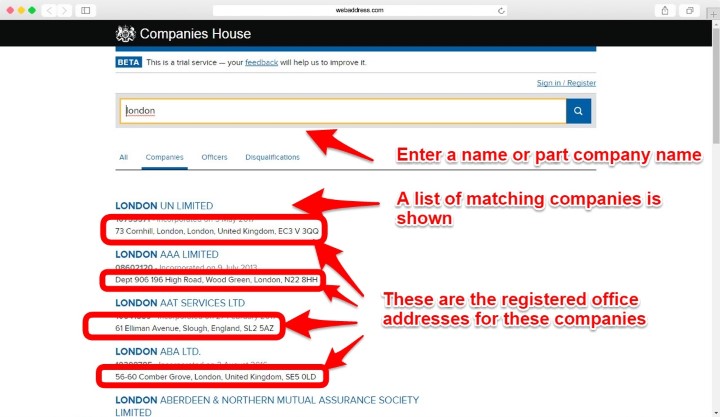

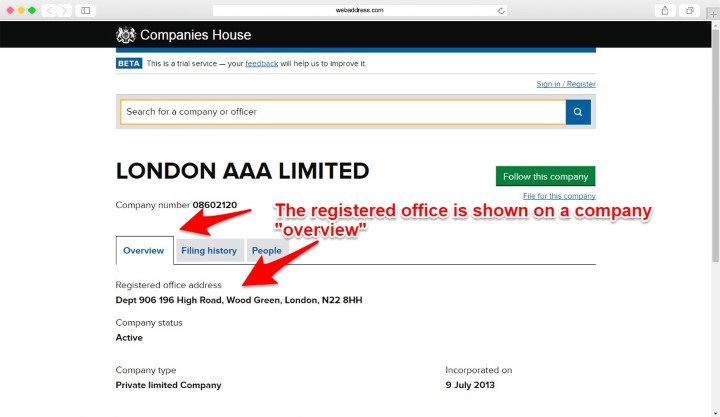

You just need to be aware that the registered office address will be available on the public database, along with the names of the company directors and shareholders. If you rent your home you should check your tenancy agreement as many landlords will not permit use of the property for running a business.

The Registered Office Address is the main address for the company. It is also where you are supposed to keep company documents and accounts so that they are available for inspection by HMRC and others. A registered office address should be in the UK and cannot normally be a PO Box unless you have the full address including the street address.

Where should I show my registered office address?

As a limited company you are legally required to put your registered office address on any ‘company communications’. This includes invoices, brochures, websites, letters, emails and anything else you are sending out so this will be one of the main points of contact for anyone who wants to get in touch with your business. Your registered office address will also be published on the government’s website so that anyone can look it up.

If you are not comfortable having your home address publicised then you are allowed to use service addresses instead. Company formation agents like The Company Warehouse, and some accountants, provide a Registered Office Service. This allows you to register your company to their office and they will then forward on any mail they receive.

7 - Appointing company directors

Who can be a company director?

Every limited company has to have at least 1 company director. If you are setting up a limited company on your own this can be you. The only real restrictions on who can be a company director are that you have to be over the age of 16 and not have been disqualified from being a company director as a result of legal action or bankruptcy (you will generally know if this applies to you).

In practice although 16 year olds are legally allowed to be company directors they will struggle to open a business bank account until they are 18. This makes it very hard for them to run a company on their own.

What do company directors do?

Company directors are legally responsible for making sure the company is run correctly. If the company breaks the law it is the company directors who will be in trouble. Where there is more than one company director it is normal to have each company director’s areas of responsibilities formally written down. So, one company director might be responsible for making sure health and safety rules are followed, while another is responsible for making sure the company pays its taxes on time.

The company directors don’t have to be shareholders and they don’t have to be involved in the day to day running of the business. However, it is best to keep the company directors to people who need to be involved and who you are happy you can work with to avoid potential problems.

8 - Directors addresses

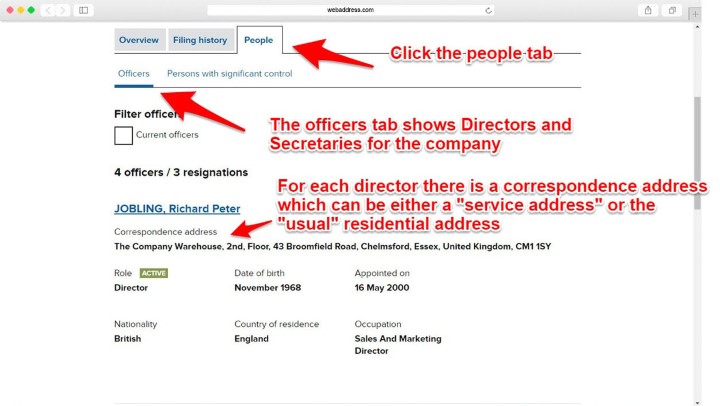

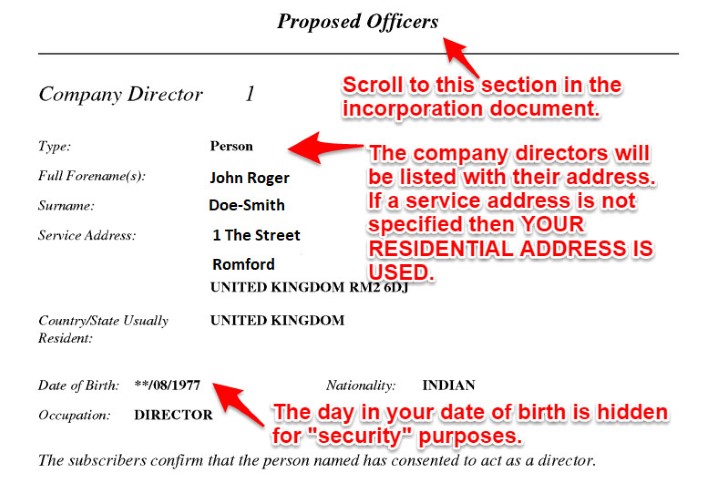

Director's Residential Address

When setting up a limited company all directors must provide their ‘usual residential address’. This does not have to be a UK address. As the name suggests it is the address where you usually live. If this is the only address that you provide for the company director then this is what will be listed on the government website and on your publicly available company documents.

Director's Service Address

In addition to the usual residential address the Companies Act provides that a director may specify a ‘director’s service address’ to be entered on the public record. This acts as a correspondence address to which any notices can be sent to the director. This has the effect of hiding the residential address as it is the service address that will be used on the government website and company documents.

Protecting your privacy

If you want to hide your residential address then this has to be done when the company is first being setup. If you do not specify a director’s service address your usual residential address will appear on the public record as the correspondence address. If you change a company after incorporation to use a director’ service address the usual residential address will still be available on the original incorporation documents.

It is possible to get an exemption where you can completely hide any addresses from public view but this is rare. Normally this is only allowed for people involved in animal research or other highly controversial businesses where their home might be targeted by protestors. Exemptions can also be gained for businesses which handle large sums of cash and for people in the entertainment industry.

9 - Company shareholders

Shareholder rules

Every limited company must have at least 1 shareholder. There are no restrictions on who can be a company shareholder.

What's the difference between a shareholder and a director?

The shareholders of a limited company are the people that own that business.

The directors of a limited company are responsible for running the company. It is quite usual in small companies for the directors and shareholders to be the same people.

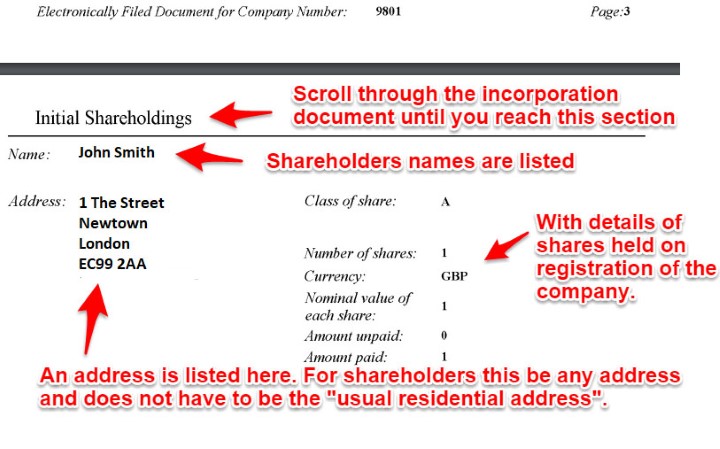

Shareholder addresses

As with company directors shareholders have to provide an address but this can be the service address. There is no requirement for the shareholders to show their usual residential address.

If you are having additional shareholders who are not directors (or the company secretary) you will have to specify an address for that shareholder. Again this does not have to be the usual residential address BUT whatever address is supplied will appear on the incorporation documents on the public record.

Shareholder voting rights

Although in practice the directors of a company take care of the day to day running of the business it is the shareholders that actually own the company. When it comes to important decisions the consent of the shareholders is required. This is done by convening a ‘shareholders meeting’ in which the shareholders will vote on the matter at hand.

Most companies are set up so that every shareholder has equal voting rights in proportion to their shareholding in the company.

This will be the case unless you set your company up with different classes of shares and amend the voting rights for the different share classes (for instance having a class of shares with no voting rights at all). For many matters decided by the shareholders an ‘ordinary resolution’ is required to be passed at a vote. This requires a simple majority to be passed (i.e. greater than 50%).

For other matters such as a resolution to change the company name the Companies Act requires a special resolution to be passed at a shareholders meeting. A special resolution requires 75% of the votes cast in order to be passed.

10 - Allocating shares

Simple share allocations

When allocating shares for a small limited company it is best practice to keep matters as simple as possible. You should issue the minimum number of shares possible to achieve the percentage of ownership that the shareholders require. When registering a company shares are usually issued as £1 shares. The following table will gives some examples on how to issue shares:

Complex share allocations

As Companies House and most formation agents use £1 shares it is not possible to implement complex shareholder apportionment. For instance where directors require shareholdings to decimal places (i.e. Shareholder A 26.5%, Shareholder B 21.25%, Shareholder C with 52.25%).

Most people starting a limited company will never have to worry about this. However, if you have a requirement to allocate shares with complex fractions or you anticipate this will happen with your business in the future it is better to set your company up with a lower share value (i.e. £0.10 or £0.01 shares). TheCompanyWarehouse.co.uk can support this, you just need to give us a call on 0800 0828 727 if this is something that you need.

| Example | How many shares to issue |

|---|---|

| Single company director who owns 100% of the company | 1 share issued to the company director |

| Two company directors who want to split ownership of the company 50/50 | 2 shares issued. 1 to each company director |

| Two company directors with a 60/40 split in ownership of the company | 10 shares issued. 6 to the person who will own 60% of the company and 4 to the person who will own 40% |

| One company director who will own 75% of the company and an investor who will own 25% | 100 shares issued. 75 to the company director and 25 to the investor. |

11 - PSCs - People with Significant Control

What is a PSC?

PSC stands for Person with Significant Control. As the name suggests this is someone who has significant control over the running of a limited company. Normally this is anyone with more than a 25% shareholding. However it can also include investors or, where there is a corporate shareholder, the people who own that company. Since June 2016 all new limited companies have had to make a declaration of who their PSC are.

The official definition of a PSC is someone who:

- owns more than 25% of a company’s shares

- holds more than 25% of a company’s voting rights

- holds the right to appoint or remove the majority of directors

- has the right to, or actually exercises significant influence or control

- holds the right to exercise or actually exercises significant control over a trust or company that meets one of the first 4 conditions.

Why do you have to provide PSC details?

This new rule was introduced to try and stop the practice of nominee directors and shareholders where the ultimate ownership of the company was not transparent. This is where a person who is nothing to do with the day to day running of a company is appointed as a director or shareholder to hide who is really behind the company. This is a popular tactic for people involved in tax dodging, money laundering and fraud.

In most cases when setting up a limited company the PSCs will just be the shareholders that you are appointing. You are also required to keep a paper Register of your PSCs.

12 - SIC Codes - Standard Industrial Classification

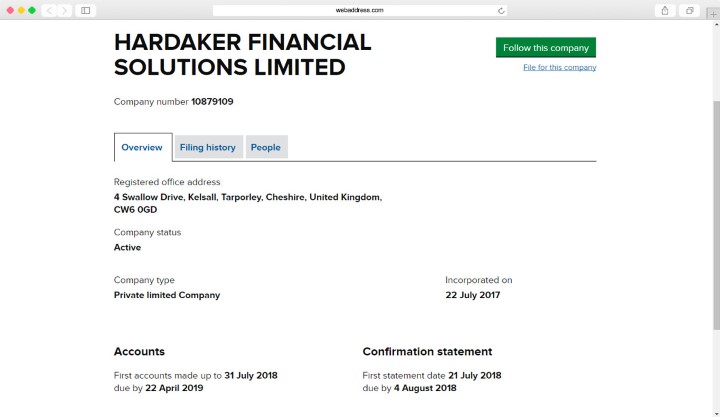

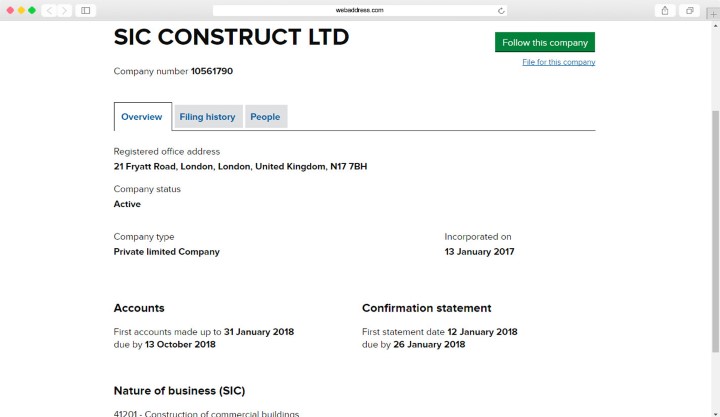

What is an SIC code?

Standard Industrial Classification (SIC) codes are mainly used for statistical purposes by the government. There are dozens of different codes covering different industries from construction through to computing. When setting up a limited company you simply have to pick an SIC code that fits your business. This lets the government know how many construction businesses are being setup each year compared to the number of computer businesses.

The requirement for new limited companies to provide an SIC code was also introduced in June 2016. Previously companies only had to state their SIC code at the end of their 1st year.

Finding the right SIC code

The SIC codes can be a little weird. They are done on an EU wide standard and don’t get updated very often so they tend to be either peculiarly specific or massively broad. In most cases you simply have to pick the least worst fit. You can have more than 1 SIC code if your business is doing a range of different things.

If you want to have a look at the different SIC codes available you can download the SIC codes as a PDF.

13 - Company registration documents

Memorandum and Articles of Association

When a new company registration is submitted to Companies House the Memorandum and Articles of Association of the company will be sent as part of the application. The Memorandum and Articles are the rule book of the company. They lay out the rules for voting on things like getting rid of company directors and who can get a dividend from the shares. The Memorandum and Articles can also be customised to give the company a specific purpose but this is only normally done with non-profit companies.

The vast majority of limited companies that get set up in the UK use model Memorandum and Articles. These are the standard rules for limited companies and will always be accepted by Companies House. When your company has been registered Companies House will send you back a copy of your Memorandum and Articles, showing that they have been accepted.

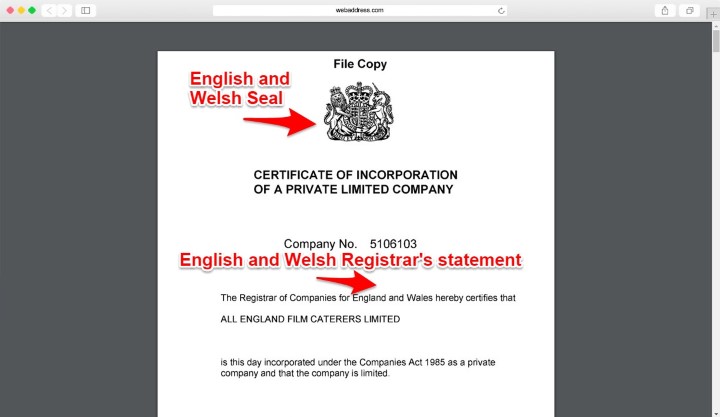

Certificate of Incorporation

As well as the Memorandum and Articles of Association your company will get a Certificate of Incorporation when it is registered. We often refer to this as the birth certificate of the company. It shows the name you have registered, the date and the company number. These days the Certificate of Incorporation comes as a PDF but it is a good idea to keep a hard copy somewhere safe (you can always frame it if you like).

14 - Minutes of the first board meeting

Even if your limited company only consists of you as the only company director and only shareholder you are still expected to hold an initial board meeting. This is where the shareholders (you) officially appoint the company directors (also you). It sounds a little silly but it is a legal requirement that you have the minutes of the meeting as they are what prove your company directors were properly appointed.

If you form a company direct with Companies House they will not provide you with the minutes of your first board meeting or any guidance on how to complete them. TheCompanyWarehouse.co.uk can provide you with the minutes of your first board meeting in the correct format to show that your company directors have been properly appointed. You just then need to keep this document in case anyone ever asks for it. We can do this for you even if you did not set up your limited company through our website.

15 - Share certificates

Share certificates show who owns your limited company. Remember it is the shareholders who own a company, not the directors, and the share certificates are proof of how much of the company each shareholder owns. You are legally required to have them and new share certificates should be issued whenever new shares are issued or the number of shares owned by different people changes.

Share certificates are pretty simple, they don’t need to look fancy, but they do need have the correct information on them in the correct way to be valid.

If you form a company direct with Companies House they will not provide you with share certificates, you will be expected to do your own. TheCompanyWarehouse.co.uk can provide you with share certificates for your new company, and we can issue new share certificates for you if you ever need to make changes to your company.

16 - Company registers

What are company registers?

As well as the Minutes of the First Board Meeting and Share Certificates there are a whole bunch of other documents which all limited companies are legally required to have. These are known as the ‘company registers’ or ‘statutory registers’.

The list of registers a limited company is required to keep are:

-

PSC Registers (People with significant control)

-

Register of Directors

-

Register of Director's Usual Residential Address

-

Register of Members (shareholders)

-

Register of Secretaries

-

Register of Mortgages and Charges

-

Register of Debentures

Where should you keep company registers?

The company registers should be kept at the registered office address of your limited company. The registers are a bit like a school register in that they contain lists of names and addresses of individuals that are involved in the company and financial information in the case of mortgages.

Should company registers be updated?

You are expected to update them as and when there are any changes to your company. The company registers should be an accurate record of what is going on with the different parts of your limited company. If you are asked to produce the company registers and don’t have them you can be fined.

Again, Companies House don’t provide these documents and you will be expected to source them yourself. The Company Warehouse can provide you with company registers whether you do a company formation with us or whether you do it somewhere else.